Sustainable Advantage® is Northern Pacific Asset Management’s holistic process, originally crafted as our proprietary investment management framework and now expanded to encompass your entire financial life. Designed for trailblazers—whether you’re building generational legacies, securing a thriving retirement, or growing an enterprise—this approach integrates Behavioral & Financial Life Counsel, Wealth Management Strategy, and Investment Management into a seamless strategy. By aligning your values, aspirations, and behaviors with your financial decisions, we empower you to live exponentially, ensuring your wealth reflects who you are and what you aim to achieve.

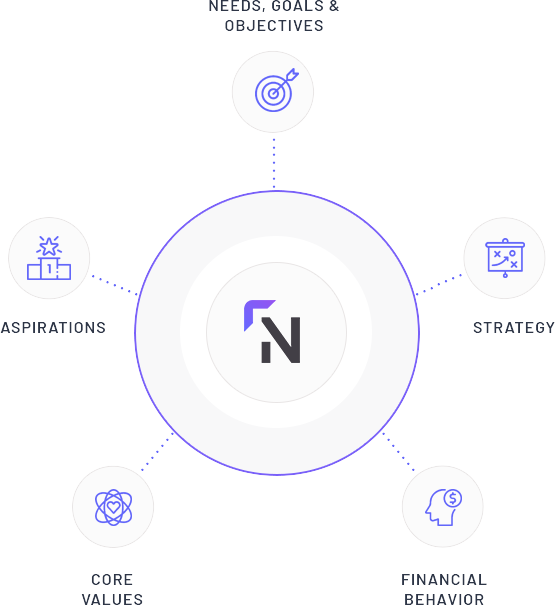

Your journey starts with you. Sustainable Advantage® begins by aligning your values, aspirations, and behavior with your financial strategy, assets, decisions, and actions. We recognize that clients with complex financial lives value their time above all—our personalized counsel goes beyond traditional planning, simplifying the intricate and freeing you to focus on what matters most.

Sustainable Advantage® optimizes your financial journey through a tailored Wealth Management Strategy, addressing every facet with precision. We proactively adapt to market shifts and personal milestones, delivering comprehensive expertise to exceed your expectations.

At Northern Pacific Asset Management, we believe asset management and portfolio construction go beyond picking securities or managers. They’re not just pie-chart slices—they’re the cornerstone of a future tailored to your goals, values, and unique journey. Our Sustainable Advantage® approach builds a solid investment foundation that strengthens your financial core and secures your prosperity.

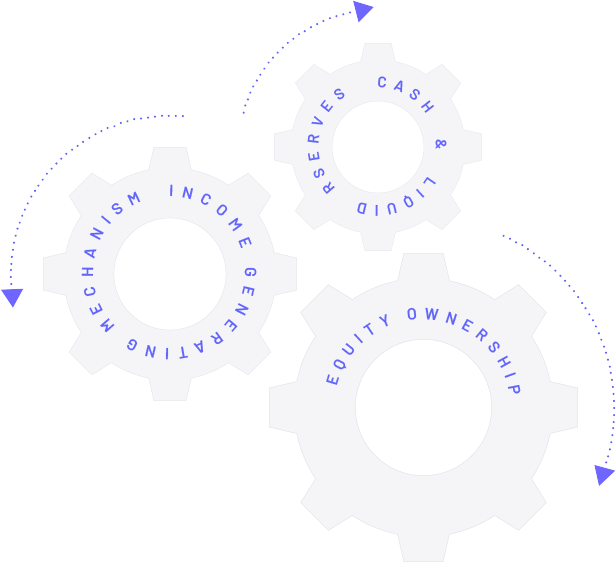

We’re committed to crafting an equity core as distinct as you—your life’s Wealth Foundation. Our strategies transcend conventional investing, offering stability through a bespoke Long Term Equity Core, innovation with our Risk Managed Global Macro Dynamic Factor Overlay™, consistency via our Income Generating Mechanism, and prudence with Cash/Currency Reserve and Treasury Management.

Dive deeper into our approach, and you’ll see how each element shapes a thriving financial future. Sustainable Advantage® isn’t just a philosophy—it’s our promise to safeguard and enhance your wealth for the journey ahead.

Strengthen your long-term investment core with Sustainable Advantage®

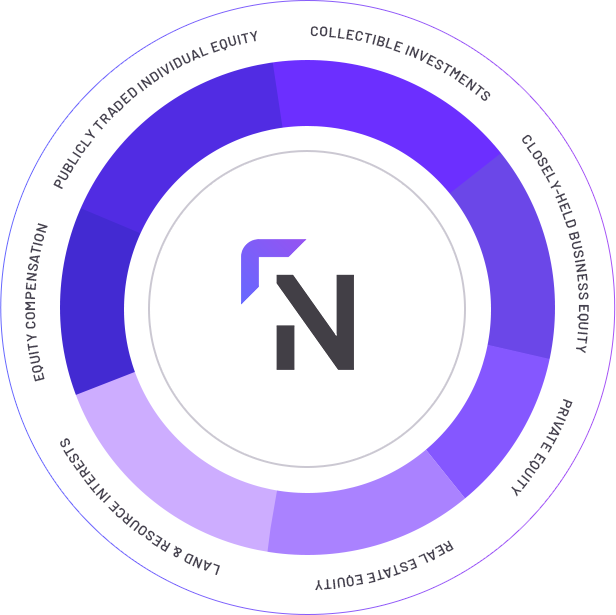

Your long-term investments form the bedrock of your wealth. At Northern Pacific Asset Management, we believe that effective portfolio management and wealth building begin with a robust long-term equity core. This core may include privately-owned real estate, closely-held businesses, private equity interests, collectibles, land, resource and royalty interests, company-issued stock options, and concentrated positions in liquid, publicly-traded equities—each selected for their Sustainable Competitive Advantage.

Our process starts by defining and modeling your long-term investments, which we call your Wealth Foundation. This provides a clear, comprehensive view of your total equity picture. Working closely with you, we craft an investment policy tailored to your values, tax strategy, income needs, liquidity goals, and diversification priorities—ensuring confidence as your wealth grows.

Modeling your Wealth Foundation also informs critical decisions: distributing excess profits and income, diversifying concentrated business or real estate holdings, mitigating risks from over-concentration in illiquid assets or company stock, and preparing for future liquidity and tax events.

With your foundation and policy in place, we strengthen your equity core by acquiring and expanding long stock positions in publicly-traded companies with a sustainable competitive advantage. These positions create a diversified, liquid economic moat that enhances resilience and supports your long-term vision.

Our tax-management approach maximizes efficiency and minimizes disruption. We aim to hold positions permanently, capture long-term capital gains when needed, and employ tax-loss harvesting and strategic reallocation—all designed to protect your wealth and deliver confidence.

At Northern Pacific Asset Management, we’re dedicated to building and maintaining a resilient long-term equity core—a cornerstone of your wealth that endures and thrives, giving you confidence in your financial future.

In today’s ever-shifting investment landscape, effective asset allocation demands adaptability. Our Risk Managed Global Macro Dynamic Factor Overlay™ Strategy enhances diversification, strives to deliver tailored performance, and complements your “Equity Core” with agility and depth.

This strategy is designed to provide stability, mitigate risk, and adapt to your unique financial goals, fortifying your wealth against uncertainty.

We begin with a baseline equal-weight allocation across key factors, balancing risk by asset class, investment style, and behavior, then customize with personalized tilts and macro adjustments.

See how we adapt the strategy to different investor priorities with these examples.

Income-Focused Investors: Might favor “Quality,” “Dividend Growth,” “Low-Volatility,” and “Carry” factors, with a market-neutral risk parity allocation tilted toward commodities and precious metals for inflation protection, ensuring steady income with reduced volatility.

Our strategy dynamically adjusts to business cycles and credit market risks, keeping your portfolio aligned with your aspirations and the economic environment.

Our Risk Managed Global Macro Dynamic Factor Overlay™ Strategy is a proactive framework that navigates complexity with precision, prioritizing diversification, risk management, liquidity, and resilience.

At Northern Pacific Asset Management, we recognize that a sound financial strategy begins with a secure and adaptable foundation. Our Liquid Cash, Currency, Bullion Reserves, and Treasury Management approach is meticulously crafted to deliver liquidity, security, and inflation protection—ensuring your wealth remains anchored amidst dynamic markets and economic shifts.

This strategy spans a robust spectrum of options:

Whether you need immediate liquidity, protection against inflation, or a buffer for future opportunities, we tailor these solutions to fortify your financial bedrock. For example, physical gold bullion enhances stability and defends against economic uncertainty, while Treasuries and CDs provide reliable income and capital preservation.

This approach complements your broader wealth plan by:

Our Liquid Cash, Currency, Bullion Reserves, and Treasury Management strategy is more than a safety net—it’s a cornerstone of your financial confidence. By blending FDIC-insured reserves, high-quality fixed income, and precious metals, we create a dynamic yet dependable anchor for your wealth. In an unpredictable world, this foundation delivers the confidence and stability you need to thrive.

At Northern Pacific Asset Management, we understand that rising interest rates and economic shifts demand a robust, adaptable income strategy. Our Income Generating Mechanism (IGM) is designed to deliver steady, sustainable cash flow while navigating uncertainty—ensuring your portfolio thrives over the long term.

We take an opportunistic yet disciplined approach:

We also integrate your existing income-producing assets—closely-held businesses, real estate, trusts, concentrated dividend-paying equities, royalties, or resource interests—into a comprehensive IGM model. This ensures a diversified, cohesive income stream tailored to your financial picture.

For specialized income needs, we collaborate with third-party asset managers and incorporate separately managed accounts within our Unified Managed Account structure. This expands your access to bespoke opportunities, aligning income generation with your unique goals—whether that’s inflation-proof cash flow, tax optimization, or growth.

In a volatile world, our IGM provides:

Our Income Generating Mechanism is more than a tool—it’s a cornerstone of your wealth plan. By blending dynamic strategies with your existing assets, we strive to craft a sustainable income stream that adapts to change and is designed to stand the test of time. At Northern Pacific Asset Management, we’re committed to securing your financial stability, no matter what lies ahead.