Why Psychological Bias—and Not Just Policy—Is Distorting Wealth Outcomes for Progressive West Coast Investors

In today’s hyper-polarized world, the socio-political news cycle does more than inform—it profoundly influences the emotional well-being and financial trajectories of millions, particularly among affluent and progressive individuals. Behavioral finance and psychology research reveal that our brains are inherently wired for tribal affiliation, safety, and social validation. In an era dominated by hyper-personalized media algorithms and rapid technological advancements, these primal instincts can inadvertently steer even the most astute investors away from optimal wealth compounding and building a lasting legacy. For wealth-focused progressives and the behavioral science community, this is not just a practical challenge but a critical imperative: to rigorously investigate and mitigate the psychological forces that misalign societal values with portfolio performance.

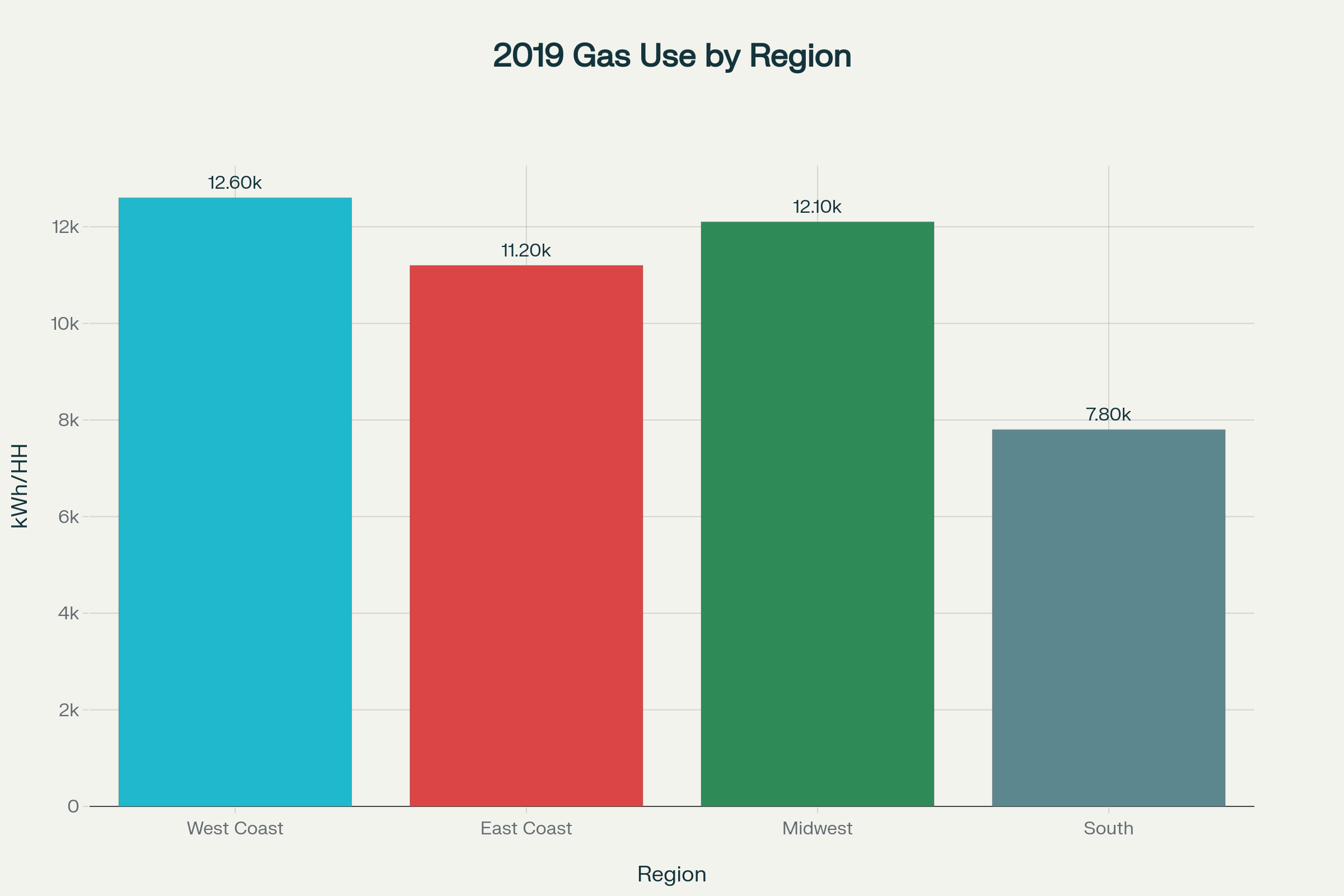

Progressive hubs like San Francisco, Los Angeles, Portland, and Seattle feature high rates of natural gas usage in households and commercial settings. According to the U.S. Energy Information Administration (EIA), over 70% of homes in parts of the West region rely on natural gas for essential needs such as heating, hot water, and cooking—higher penetration than in many other regions for certain end uses. Historical data (e.g., 2019 regional analyses) shows variation in per-household consumption, with colder climates driving higher usage overall.

Despite this everyday reliance, progressive investor portfolios often diverge from economic reality. Many affluent, politically engaged urban investors underweight or exclude natural gas and midstream energy sectors, even as these assets serve as a critical bridge in the transition toward renewables, AI data centers, and broader electrification. The International Energy Agency (IEA) notes that natural gas will stabilize grids during this transition, with demand in advanced economies projected to remain resilient or see modest changes through 2030 depending on policy scenarios.

Even leading voices in Silicon Valley now openly acknowledge this reality. In a16z’s November 2025 research piece “Gas-Fired Intelligence”, Michael Spyker of HTM Energy makes the pragmatic case that natural gas is currently the only scalable, reliable, and fast-to-deploy power source capable of meeting AI’s explosive electricity demand — and that it is 50–70% cleaner than coal on a per-unit-of-energy basis. The report argues for building gas capacity first, then layering renewables on top, noting that gas plants can be deployed in months to years while nuclear takes a decade+ and renewables remain intermittent. For progressive investors who care deeply about both climate progress and continued technological leadership, embracing natural gas as the bridge fuel is not a compromise — it is the most responsible path to abundant, reliable energy without sacrificing AI advancement or economic growth.

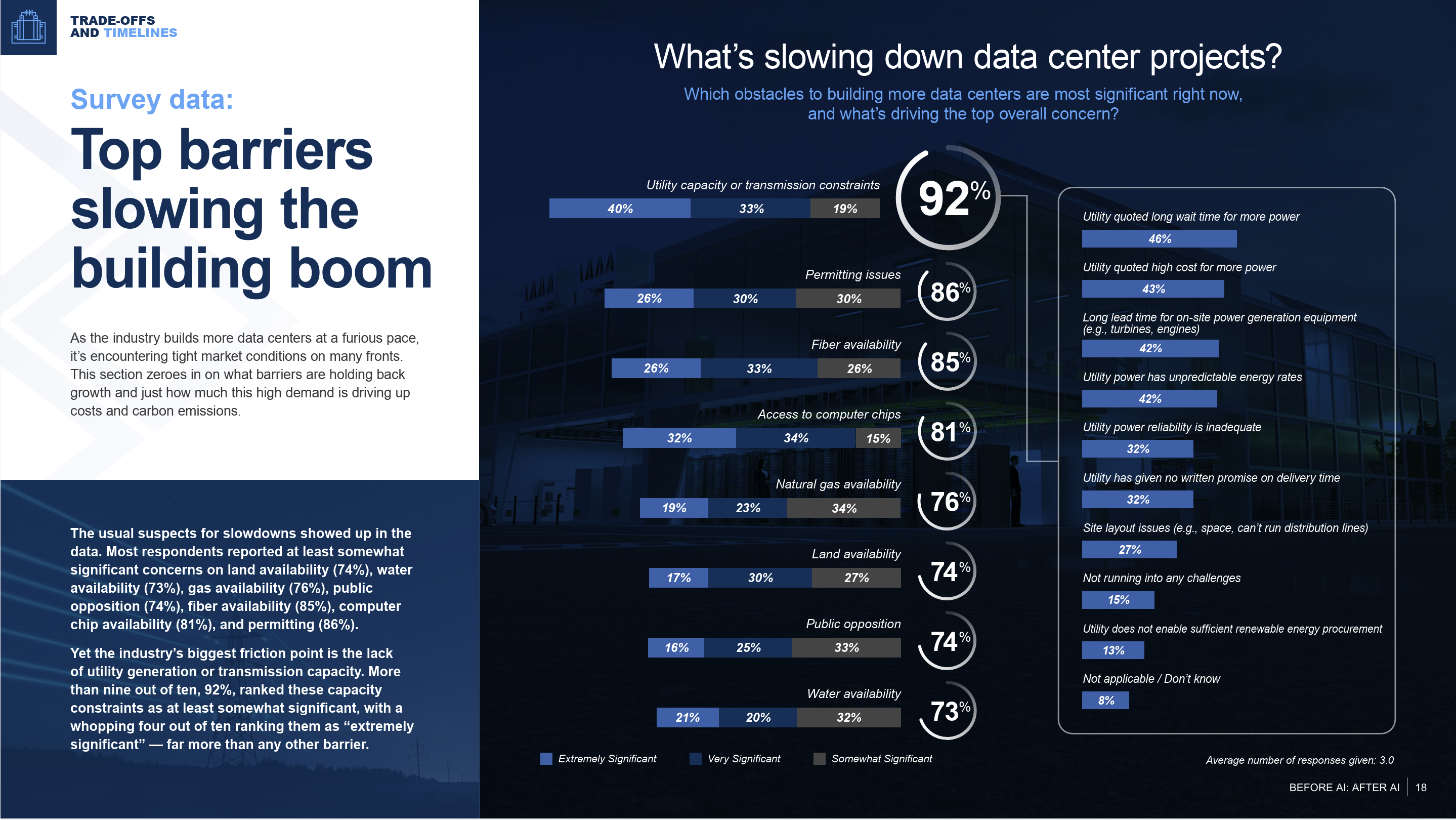

As AI and electrification drive unprecedented demand for data centers, energy-related obstacles are emerging as critical hurdles. The landmark AlphaStruxure / Schneider Electric / Data Center Frontier energy crunch survey (2025) finds grid constraints are now the #1 barrier to new data center builds—cited by 92% of North American industry respondents. Nearly half report utility wait times now exceed four years, with almost 50% noting an average new data center size above 100 megawatts. This signals a scale of development—and delay—never seen before. The survey of 149 senior professionals highlights that six in ten are building more than 10 data centers over the next five years, with 25% planning at least 30. Long wait times from utilities are the top-ranked barrier in getting more electrical capacity. 35% reported their carbon emissions accelerated over the past two years, since the AI race began.

Beyond utilities, top expansion obstacles for 2025 include chip shortages, fiber and land constraints, water scarcity, permitting, and critically, gas availability for on-site generation. In response, 62% of organizations are developing on-site power solutions, especially batteries (50%) and solar (39%), as backup or even prime generation. The Midwest has emerged as the top “Plan B” region for urgent new builds when primary markets cannot supply power fast enough. The survey details regional variations in time to power, with Mountain West showing the fastest recent times, though sample sizes vary. For more details, see the full survey report (PDF).

This data illustrates a central dilemma: shunning natural gas, due to ideology rather than evidence, risks excluding sectors that are essential to powering the AI-based economy. With data centers projected to consume 6-12% of U.S. electricity by 2030 (depending on scenarios from sources like LBNL, EPRI, and McKinsey), prudent natural gas investments may offer both impact and stable returns.

Confirmation Bias: Investors tend to favor information that reinforces their existing beliefs and identity. In progressive communities, this can manifest as viewing natural gas, pipelines, or traditional energy as inherently “unacceptable,” despite empirical data underscoring their transitional importance in reducing emissions compared to coal and enabling data center growth. A March 2025 study from the University of Washington and collaborators on the political divide and partisan portfolio disagreement illustrates how such biases lead to suboptimal asset allocation, with partisan perceptual screens—akin to confirmation bias—causing individuals to interpret economic data through their party’s lens, potentially reducing returns by favoring ideologically aligned but underperforming sectors. The study finds that partisan portfolio disagreement (PPD) among wealthy U.S. households more than doubled between 2001 and 2019, reaching an average of 20% by 2019, driven by a growing number of partisan stocks, particularly politically sensitive and large-cap ones. Expanding this, causal evidence from the staggered entry of a conservative television network shows that political disagreement amplifies portfolio divergence in polarized environments, further entrenching avoidance of certain industries. Political Divide and Partisan Portfolio Disagreement 2025

Loss Aversion: The fear of losses—often heightened by political uncertainty or policy shifts—can prompt a “flight to safety,” such as slashing equity exposure or pivoting to trendy ESG funds without thorough due diligence. This behavior can erode long-term wealth, as investors miss rebounds in undervalued sectors like energy amid data center demands. In a polarized landscape, this bias is exacerbated by election cycles, where perceived policy risks lead to premature sell-offs. For progressive investors, loss aversion might mean avoiding natural gas investments due to fears of regulatory changes or reputational risks, even when fundamentals suggest stability and growth in supporting AI infrastructure.

Herding: Social networks and digital platforms dictate “acceptable” investments, often sidelining sectors that quietly support progressive lifestyles, like reliable energy for tech infrastructure and AI data centers. Herding effects are stronger in ideologically homogeneous groups, leading to overconcentration in volatile assets. This is particularly relevant today, as algorithmic feeds reinforce groupthink, contributing to bubbles in “green” tech while ignoring foundational enablers like natural gas for power stability. In progressive circles, herding can create a consensus around excluding traditional energy, missing opportunities in assets that bridge the gap to renewables and electrification.

Anchoring: Clinging to outdated notions of “responsible investing” ignores the evolving landscape of climate and technology leadership, including the need for natural gas in addressing data center energy constraints. Anchoring bias causes reliance on initial ESG ratings or reference points, preventing adaptation to new data such as AI-driven efficiencies in energy sectors. This interacts with partisanship, leading investors to undervalue innovations that don’t fit rigid ideological frames. For example, anchoring to early views of natural gas as purely “dirty” energy overlooks its current role in stabilizing grids for the AI boom.

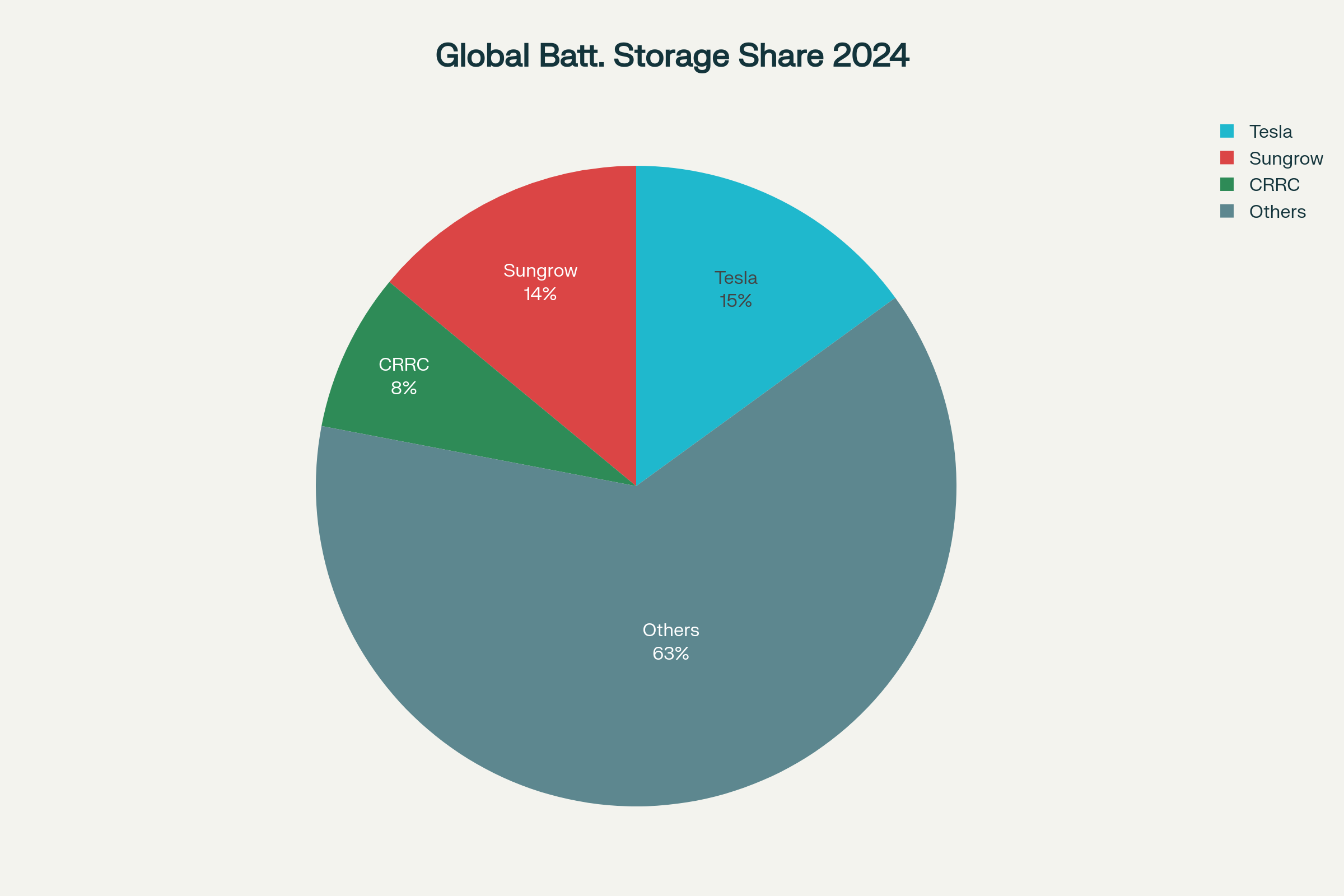

Tesla is more than just an electric vehicle company. It holds 15% of the global battery energy storage system (BESS) market and a leading position in North America, a position that supports grid resilience and the transition to renewable integration—both essential for the next generation of data centers. Deployments like the Megapack help sustain AI development and residential backup systems.

Tesla is also advancing AI and robotics, with significant potential in the projected multi-trillion-dollar robotaxi and humanoid robot sectors. ARK Invest highlights Tesla’s opportunities in these areas. For more on ARK Invest’s projections, see the Big Ideas 2025 Report (PDF).

In a polarized era, letting social or political narratives dictate allocation decisions may exclude transformative innovations—and significant, sustainable value creation.

Behavioral traps are no longer just about trading errors. Today, identity, social networks, and media polarization create persistent gaps in intergenerational wealth, especially in tech-forward regions. Ongoing research is needed to quantify the influence of digital tribalism and to develop tools that help investors and advisors recognize and correct these biases.

The coming decade of behavioral finance research will be pivotal for ensuring not just financial, but also emotional and societal, resilience as polarization intensifies.

Audit your sources and research methodologies regularly, and commit to stepping outside your usual “echo chamber.” Pause and check your own emotions before any major investment shift; neutral advisors and checklists can help avoid reactive missteps. Work with data-driven, bias-aware advisors who acknowledge behavioral traps and document their reasoning for all allocations. At Northern Pacific, this is the foundation of our Sustainable Advantage® process—a disciplined framework that integrates investment analysis with behavioral insights to align progressive values with pragmatic opportunities in energy, AI, and beyond. Finally, always anchor decisions on genuine usage patterns and business fundamentals, not partisan headlines or fleeting trends.

Northern Pacific Asset Management:

At Northern Pacific, we blend behavioral science, in-depth sector analytics, and bias-aware wealth counseling. For our clients—particularly progressive leaders and thinkers—debiasing isn’t just about positive returns; it’s about building legacies and real impact in a volatile world.

“In an age of echo chambers and algorithmic news feeds, your portfolio’s greatest risk—and greatest opportunity—is the courage to think beyond your own tribe.”

— Northern Pacific Private Advisory Team

Subscribe to receive relevant news, insights, and portfolio updates—keeping you informed and in control.